Train Capacity and Allocation Pricing Review

When multiple train operating companies run services over the same stretches of track, decisions about allocation of train slots and how much each operator pays for those train slots, can became a complex and debated issue.

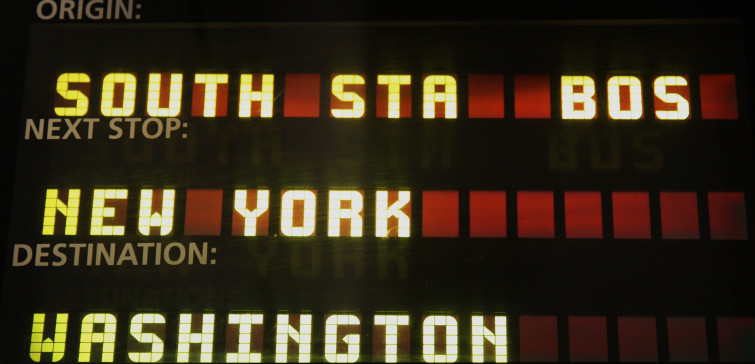

Amtrak is both the infrastructure provider and operator of intercity trains on the Northeast Corridor, the busiest passenger rail line in the United States. Eight other commuter authorities and a number of freight railways share portions of the Corridor with service levels forecast to increase over time. Amtrak required support to consider a slot capacity allocation and pricing strategy for all operators on the Northeast Corridor and looked to Network Rail Consulting to provide this support.

Network Rail operates in the world’s most liberalised rail market with 23 train-operating companies and 7 freight-operating companies using our infrastructure. This has required us to develop and refine a series of policies and processes to optimise slot capacity allocation and pricing. We were thus well placed to provide advisory support and share our experience with Amtrak.

Train Capacity and Allocation Pricing Review

Network Rail Consulting was engaged to provide an in-depth view of policies and processes for the allocation and pricing of slots/capacity used on the Great Britain (GB) rail network. We were tasked with explaining how slots were allocated between companies, how disputes over the allocation of slots were resolved, and how the methodology for pricing the slots is used. We explained the complex formula that governs the scheme by which different train operators share the infrastructure. We also included a breakdown of pricing variations between different types of operators that run slots on different routes at different times of day.

We were asked to give an overview of rail capacity allocation and pricing models used in other European railroads and how they relate to GB’s approach. France, Germany and Sweden were chosen for comparison with the GB model, and study of their processes was completed.

Finally, Amtrak requested a description of the possible options to consider for use on the Northeast Corridor (NEC). The output from the work in a detailed report and follow-up webinar was to serve as a starting point for further work to be carried out internally within Amtrak.

Train Capacity and Allocation Pricing Review

The final report and webinar were broken into three related work streams, the first of which focused on the legislative environment governing the industry in Europe. Deliverables involved a detailed assessment of the GB capacity allocation and pricing structure followed by in-depth insights into policies and processes that included:

- European and GB rail legislative environments and key points

- overview of GB train operator organisation – Franchised, Open Access Passenger and Freight Operators

- GB Rail Capacity Allocation methodology including issues around Franchised and

- Open Access Operators

- GB Franchised Operator capacity pricing structure, heavily based on the type of equipment operated

- GB Open Access and Freight capacity pricing

- compensating for poor performance (Performance Regimes).

The second stage of the report and webinar provided an overview of capacity allocation and pricing models used in other European countries. Our review focused on providing a comprehensive review of the models used in France, Germany and Sweden.

The report covered the differences between Europe and Great Britain in relation to the Amtrak/NEC competitive rail environment and discussed the pros and cons of the different reports.

The final stage of the report and webinar highlighted a number of potential options for Amtrak to consider for the NEC, pinpointing relative strengths and key issues and identifying any further work that may be required.

Train Capacity and Allocation Pricing Review

Client: National Railroad Passenger Corporation (Amtrak)

Location: Northeast Corridor, US

Start date: February 2015

End date: August 2015

Duration: 7 months

Services provided: Advisory, strategic planning, systems analysis