The Future is Off-Peak: A Discussion of Passenger Growth Opportunities

Image: Euston Station, London, iStockAt Network Rail Consulting (NRC), we passionately believe in growing railway usage, with more passengers travelling and more freight carried. However, there have been recent major challenges to this, with worldwide experience being far fewer passengers in the traditional weekday peaks, caused by working from home remaining normalised following the pandemic.

NRC is observing how railway operators are adapting to the new circumstances, including the sudden substantial reduction in farebox revenue from ticket sales to commuters caused by the pandemic. Whilst this has been a major concern to the industry, we now see widespread optimism emerging and growth returning. Many railways are seeing a new type of passenger, rather than the traditional five-days a week commuter.

Opportunities

Whilst there has been a shift away from the weekday peaks, NRC is observing major new opportunities for rail to grow at other times. Positive factors of this for the rail industry would include:

- Commuter-based railways are expensive to operate, since many of the trains, full staffing and infrastructure capacity are only required twice each weekday. If passengers can be more evenly spread across the day the future railway will see better utilisation of fixed assets and resources, enabling growth without adding costs;

- In response to previous commuter crowding, many railways have formulated their investment plans around adding peak capacity. These typically involve complex physical track upgrade schemes, often in congested city centres, with long-lead times and sizeable spend. As the emphasis has moved away from such capital schemes strategic priorities and funding opportunities can become more available for operational improvements; and

- If the industry’s service offer is right, off-peak rail growth can occur rapidly. Only a small modal shift is needed for rail to grow significantly, with associated revenue growth on trains and at stations. It typically involves providing a product which is seen as competitive with car journeys (or planes) on the route, considering timings, costings and the journey experience, and our experience is that this is usually achievable.

Our Experience

NRC is a subsidiary company to Network Rail, the owner of one of the most complex railway networks in the world, where our colleagues work across the industry to understand trends and inform priorities.

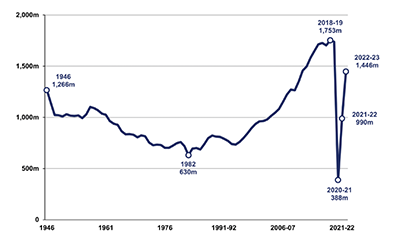

Graph: Passenger Rail Usage since 1946,

dataportal.orr.gov.uk (published March 2023)This graph shows overall passenger rail usage figures in Great Britain. The impact of the pandemic can be clearly seen, with overall rail usage now recovering, but only having reached around 80% of pre-pandemic levels.

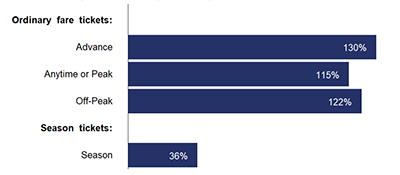

There are, however, major differences by time of journey. Considering the UK’s trends in more detail, our colleagues at Network Rail and train operators are finding that traditional commuter peaks remain well below pre-pandemic levels, but there is strong recovery off-peak, with usage exceeding pre-pandemic figures in many areas. An indicator of this is the ticket type that passengers have purchased, as shown by the chart below (from the ORR’s January to March 2023 figures), comparing purchases made during this period as a percentage of those in the same period four years earlier.

Graph: Passenger ticket types (January – March 2023),

dataportal.orr.gov.ukThis shows that season tickets, which provide five-day-a-week commuters with the lowest price fares, are now purchased in much lower numbers than before the pandemic, whereas other ticket types have increased markedly. This is from a combination of commuters travelling less often and at non-peak times, and new rail users throughout the day.

NRC’s observation is that a similar trend away from peak commuting and towards more off-peak travel is occurring in railways elsewhere.

How to Capture New Growth Markets

Image: Metro Trains Melbourne,

Brighton Beach Station, iStockThe key factor in considering the passenger off-peak is to understand that this is a leisure-based market, with people generally choosing to travel rather than having to, with multiple options available for how they might make a journey.

Many of these potential users can be people who never currently use rail.

Facilitating growth in off-peak leisure travel, as currently being experienced on the UK railway, can require significant adaptions to the rail service offer, making trains attractive to those previously driving or flying. It requires reliability, predictability, innovation and customer service, for example:

- Better all-day timetables, with higher frequencies and features such as separate express and stopping services throughout the day (rather than all trains calling everywhere);

- Value for money fares, simple to understand in advance and easy to buy, including for groups such as families;

- High levels of performance, considering punctuality as experienced by the passenger, cancellations, missed connections and the response to major incidents;

- Provision of information and assistance, especially when things go wrong. This should reliably be available in real-time on trains, at stations and online;

- Modern and comfortable trains, regularly cleaned throughout the day, with seats available;

- Making stations into destinations that people enjoy passing through. This includes high quality catering and retail, and reliable facilities such as lifts and toilets;

- Safe and easy access to nearby demand drivers, with good walking routes that people are comfortable using at all times of day and night, clear bus connections, taxis and sufficient secure car parking;

- The rail operator having a good understanding of special events in the area served, typically working with organisers to promote access to these by rail, for example through inclusion in the ticket price; and

- Rethinking engineering work, for example closing lines midweek rather than on busy weekends is now undertaken as routine in many areas, with substantial benefits. Where bus replacements are unavoidable it is essential that passengers know this many weeks in advance and that a quality service is provided.

Potential Risks

Some current rail industry planning processes can lead to off-peak growth opportunities not being fully realised. Issues can include:

- Funders and stakeholders can sometimes become focussed on physical delivery of high-profile capital expenditure schemes, rather than the delivery of benefits. Improving the off-peak can usually be achieved within existing asset capability, so may not always be prioritised in investment planning;

- Many jurisdictions utilise an approach to demand forecasting which is based on pre-pandemic drivers of peak growth (population, economics), rather than assessing the needs of other times. Leisure demand can be harder to forecast reliably than commuting and changes more rapidly, so may require a more agile analysis approach;

- Innovation in growth initiatives may be required. It may be necessary to experiment and accept initial risk, with the approach modified where necessary; and

- Whilst it is usually relatively easy to improve off-peak timetables this is not always the case. Many railways have high levels of freight, with key flows growing. Rail networks can also be physically asymmetric, some having three-track sections which are optimised for peak capacity but do not allow a quality off-peak solution.

The Future Passenger Market

Current trends suggest that future passenger demand growth will be increasingly off-peak. Key features which will result from this include:

- A railway which is used by a more diverse group of passengers, rather than being dominated by commuters into city centres;

- A railway which aides economic growth in areas including tourism, retail, leisure, entertainment, nightlife and sporting events;

- A sustainable funding model, with efficient use of capacity throughout the day;

- Journeys in which time can be used productively, communicating with friends, catching up on personal tasks, reading or researching the internet; and

- An increased contribution to reducing road congestion, emissions and accidents.

How Network Rail Consulting Can Help

NRC are active in North America, Australia and the Middle East, with a mixture of local experts and those with experience from the UK rail network. We have extensive experience in strategic planning, timetable concept development and investment appraisals of relevance to this paper.

For more details on how we can help visit www.networkrailconsulting.com.

Ben Craig

Associate Director, Rail Operations Specialist

Network Rail Consulting